The Silent Fear That Haunts Divorce Proceedings

Your hands tremble as you review the divorce settlement documents. Meanwhile, your ex seems strangely confident about affording the family house—the one you both agreed was “impossible” for a single income. Something doesn’t add up.

Has he landed a lucrative job? Paid off debts you didn’t know about? Inherited money? Unfortunately, hidden financial changes during divorce are far more common than most people realize.

The stakes are enormous. If your ex-spouse conceals a new job, inheritance, or sudden income boost, you could lose thousands in fair asset division and alimony calculations. Divorce financial disclosure isn’t just a legal formality—it’s the cornerstone of a fair settlement. Moreover, failing to uncover these changes could mean your ex walks away with assets that rightfully belong to you.

This guide reveals the proven methods divorce attorneys and forensic accountants use to detect hidden income, new employment, and asset concealment. Additionally, you’ll learn the red flags to watch for and the actionable steps you can take immediately to protect your financial future.

Why Financial Disclosure Matters Now More Than Ever

The landscape of divorce financial discovery has transformed dramatically in 2024-2025. Meanwhile, more sophisticated methods of hiding assets have emerged, making transparency—and the tools to enforce it—absolutely critical.

Here’s the reality: Roughly 23% of divorcees openly admitted to attempting to hide financial assets during their divorce. However, experts believe the actual figure is substantially higher. Furthermore, financial disclosure disputes remain the leading cause of divorce case delays and adjournments. In fact, some cases extend by months or even years simply because one party refuses to fully disclose income sources.

The good news? Modern financial technology and legal discovery tools make concealment increasingly difficult. Additionally, courts now have unprecedented access to digital evidence, bank records, and financial patterns that reveal hidden income streams. Therefore, if your ex is trying to hide financial changes that would affect house affordability, there are concrete steps you can take immediately.

Common Myths, Mistakes & Misunderstandings About Hidden Assets

Before diving into detection methods, let’s debunk what many people wrongly believe about divorce financial disclosure.

For example, one spouse may believe that receiving a $50,000 inheritance months into divorce proceedings is “their own money” and refuse to disclose it. In reality, courts often classify this as a material financial change requiring immediate disclosure and potential renegotiation of settlement terms.

Instead of hoping your ex will voluntarily disclose, proactive investigation protects your interests legally and financially.

Actionable Tips & Practical Strategies to Uncover Financial Changes

1. Conduct a Comprehensive Lifestyle Analysis

What It Is: Compare your ex’s spending, purchases, and lifestyle to their disclosed income sources.

Why It Works: People cannot maintain a high-lifestyle indefinitely without corresponding income. Meanwhile, luxury purchases, frequent travel, or property upgrades reveal financial resources not yet disclosed.

How to Do It:

- Review past tax returns (request 3-5 years) to establish normal spending patterns

- Compare disclosed income against actual lifestyle for the past 12 months

- Document luxury purchases: jewelry, vehicles, vacations, art, collectibles

- Note any property upgrades, renovations, or real estate acquisitions

- Check for high-value subscriptions, club memberships, or private school tuition

Real Case Example: A husband claimed his new job paid $55,000 annually. However, his spouse noticed credit card statements showing $8,000 monthly spending on dining, travel, and entertainment. Additionally, security camera footage revealed two luxury vehicles in his driveway. Forensic investigation uncovered a second employment position paying $75,000 that he failed to disclose. Ultimately, the settlement was adjusted to reflect the true income.

2. Monitor Social Media and Digital Footprints

What It Is: Legal, public investigation of your ex’s online presence.

Why It Works: People often reveal financial information voluntarily through social media. LinkedIn announcements, Instagram vacation posts, and Facebook lifestyle updates create a documented timeline.

How to Do It:

- Check LinkedIn for new job positions, promotions, or employment changes

- Review Instagram for travel location tags and luxury lifestyle indicators

- Search Facebook for major purchases or announcements

- Screenshot posts and save timestamps (use third-party tools if posts are deleted)

- Look for business ownership announcements or side-hustle promotions

- Document any “new beginnings” narrative suggesting increased financial circumstances

Furthermore, courts increasingly recognize social media as valid evidence. For instance, vacation photos showing luxury resort stays while claiming financial hardship become powerful evidence of concealed assets.

3. Request Formal Financial Disclosure and Tax Returns

What It Is: Legal demand for complete financial documentation through the discovery process.

Why It Works: Formal discovery requires sworn statements under penalty of perjury. Therefore, intentional misrepresentation carries serious legal consequences.

How to Do It:

- Work with your attorney to request complete tax returns (typically 3-5 years)

- Request bank statements for all accounts (checking, savings, investment)

- Demand pay stubs and W-2 forms for the past 12 months

- Request 1099 forms for any freelance or self-employment income

- Ask for statements from retirement accounts (401k, IRA, pension)

- Request documentation of any new employment agreements or job offers

Additionally, compare these documents for inconsistencies. For example, if tax returns show lower income than bank deposits would suggest, the difference may indicate unreported income sources.

4. Use Interrogatories and Depositions

What It Is: Formal legal questioning under oath.

Why It Works: Your attorney can pose detailed written questions (interrogatories) requiring truthful answers. Meanwhile, depositions allow in-person questioning where inconsistencies become apparent.

Strategic Questions to Ask:

- “List all sources of income for the past 24 months”

- “Describe any job offers, pending employment changes, or new business ventures”

- “Identify all bank accounts opened in the past 12 months”

- “Explain all deposits over $5,000 not already disclosed”

- “Detail any gifts, inheritances, or financial assistance received”

- “Describe all debts paid off or reduced in the past 12 months”

Case Reality: During depositions, verbal inconsistencies often surface. One spouse may claim “no new job” in written interrogatories, then admit to a pending employment offer under deposition questioning. Consequently, this contradiction strengthens your case for discovery violations.

5. Hire a Forensic Accountant

What It Is: Specialized accounting expert trained to detect financial concealment.

Why It Works: Forensic accountants use advanced analytical methods that individual investigators cannot replicate. They analyze financial patterns across multiple years and sources.

What They Can Detect:

- Undisclosed bank accounts through bank routing analysis

- Hidden business income through invoice and payment tracing

- Phantom employee payments or inflated business expenses

- Large cash withdrawals and their destinations

- Transfers to relatives or shell companies

- Cryptocurrency holdings and digital asset concealment

- Undervalued asset declarations

Cost Reality: Forensic accounting typically costs $3,000–$10,000, but recovers average hidden assets of $50,000–$100,000. Therefore, the investment yields significant returns.

6. Subpoena Third-Party Records

What It Is: Court-ordered demand for records from banks, employers, and other institutions.

Why It Works: Third parties must comply with subpoenas. Furthermore, institutions maintain records beyond what an individual can access.

Records to Subpoena:

- All bank accounts (including dormant accounts)

- Employer records confirming employment dates and salary

- Retirement account statements

- Investment brokerage accounts

- Business records and tax filings

- Credit card company statements

- Loan applications and credit reports

- Real estate transaction records

Practical Advantage: Subpoenaed documents are often more complete and accurate than self-reported financial statements. Additionally, discrepancies between subpoenaed records and sworn statements constitute proof of intentional concealment.

Read More

- When Should I Introduce My Girlfriend to My Kids After Divorce?

- Dating and Relationship Advice Nobody Tells You Until It’s Too Late

- Can’t Afford Child Support Payments: What to Do When You’re Struggling

- I Feel Like I Failed as a Husband After Divorce: How to Move Past Guilt

- My Ex Won’t Communicate About Our Kids: What to Do When They Ghost You

Data, Red Flags & Key Insights for Your Investigation

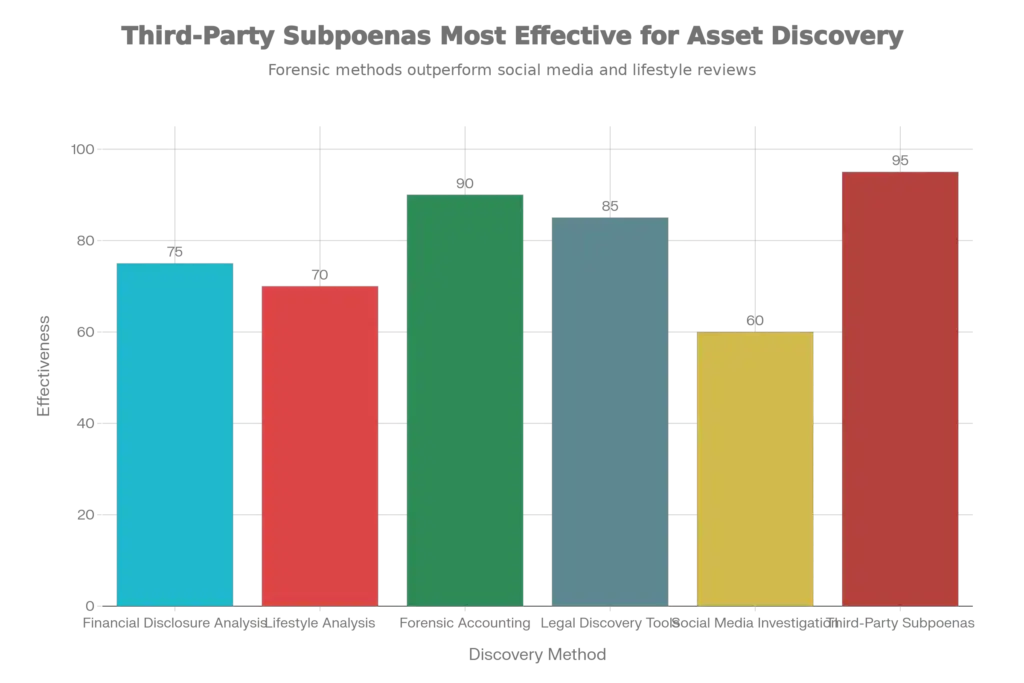

The chart reveals that third-party subpoenas are 95% effective at uncovering hidden assets, followed closely by forensic accounting at 90%. Meanwhile, social media investigation alone yields only 60% effectiveness, which is why combining multiple methods produces the strongest results.

Critical Red Flags Your Ex May Be Hiding Financial Changes

Understanding warning signs allows you to investigate proactively. Furthermore, documenting these flags strengthens your case:

- Sudden financial secrecy: Previously open about finances, now evasive about accounts or employment

- Large unexplained cash withdrawals: Frequent ATM visits or cash transfers without explanation

- New P.O. Box or mail forwarding: Redirecting financial statements from shared residence

- Job change or employment gap: New employment not mentioned during settlement discussions

- Delaying divorce proceedings: Requesting continuances while “organizing finances”

- Suspicious “gifts” to family members: Transferring assets to relatives for “safekeeping”

- Lifestyle upgrades: New vehicle, home renovations, or expensive hobby equipment

- Sudden debt reduction: Paying off credit cards or loans without clear funding source

- LinkedIn profile changes: Recent job title changes or new employment announcements

- Real estate activity: Property purchases, refinancing, or equity transfers

Comparison: DIY Investigation vs. Professional Support

| APPROACH | PROS | CONS | BEST FOR |

|---|---|---|---|

| DIY Investigation | No immediate costs; personal control; quick action possible | Limited legal standing; easy to miss patterns; evidence may be inadmissible | Initial red flag documentation; social media monitoring; lifestyle tracking |

| Attorney-Led Discovery | Legal authority; enforceable subpoenas; court backing; admissible evidence | Ongoing legal fees; longer timelines; formal procedures | Formal disclosure requests; interrogatories; depositions; third-party compliance |

| Forensic Accounting | Expert pattern recognition; complex asset tracing; professional testimony; high success rate | Significant upfront cost ($3,000–$10,000+); technical reports require interpretation | High-net-worth divorces; complex business interests; serious concealment suspected |

| Combination Approach | Comprehensive coverage; multiple verification methods; strongest evidentiary position | Highest total cost; longer overall timeline; coordination between professionals | Complex cases; significant suspected concealment; maximum financial protection |

Similarly, many cases begin with DIY investigation, then escalate to professional support when red flags emerge. Alternatively, starting with attorney guidance ensures all evidence remains legally admissible and strategically valuable.

New Employment Changes: What You Must Know

Here’s critical information: If your ex-spouse obtains new employment after divorce proceedings begin, they have a legal obligation to disclose this to you and the court.

Timeline for Disclosure:

- New job must be reported to opposing counsel within 30 days (varies by jurisdiction)

- Updated financial statements are required

- Discovery process doesn’t restart, but supplementation is mandatory

- Failure to disclose can result in penalties, sanctions, or unfavorable rulings

Impact on Alimony and Support:

- Higher income typically increases support obligations

- Courts can modify existing agreements based on substantial income changes

- Retroactive adjustments may apply back to the date of income increase

- Long-term support arrangements may be renegotiated

Mortgage Qualification Reality:

- To qualify for a mortgage to keep the house, your ex needs documented income

- Lenders require 12+ months of employment with consistent pay

- New job income may not qualify immediately if less than 12 months tenure

- Support income requires 6 months of proof and 36 months of projected continuance

Therefore, if your ex just obtained a new job months into divorce proceedings, they likely cannot immediately qualify for a solo mortgage—giving you time to investigate fully.

Conclusion: Taking Control of Your Financial Future

The uncertainty gnawing at you during divorce proceedings is real, but it doesn’t have to be permanent. Ultimately, comprehensive financial disclosure investigation transforms anxiety into evidence.

Whether your ex is hiding a new job, paying off strategic debts, or concealing inheritance, the methods in this guide expose the truth. Therefore, take action now—document red flags, gather evidence, and work with professionals who understand the stakes. Additionally, remember that courts increasingly penalize financial concealment, meaning your investigation protects not just your settlement, but also the integrity of the entire process.

In the end, a fair divorce settlement depends on full transparency. Consequently, uncovering hidden financial changes isn’t just advantageous—it’s your right.

Ready to Protect Your Financial Future?

Don’t leave your divorce settlement to chance. Comment below with your biggest concern about hidden assets, share this guide with anyone navigating divorce.

Subscribe to our newsletter for weekly updates on family law, financial planning, and divorce strategy